As the Nigerian elections draw near it

is time to look beyond the election itself to governance in the next

four years. A May 27th 2013 article published by This Day

Live on its website and titled "Ministerial score card towards

May 29th" examined the performance of the current

government of President Goodluck Jonathan by evaluating the

performance of his ministries under the ministers, who are

responsible for delivering on his transformation agenda.

The writer rated the ministries using a

qualitative rating scale; ranging from the best performance of 'Good'

through 'Above Average', 'Average but promising', 'Average' to 'Below

Average' and 'Poor'. Reproduced below in table form is the rating

assessment. I have taken the liberty of assigning numerical scores to

his rating scale to enable a quantitative assessment.

| S/N | MINISTRY | GOOD | ABOVE AVERAGE |

AVERAGE BUT PROMISING |

AVERAGE | BELOW AVERAGE |

POOR |

Score

|

6

|

5

|

4

|

3

|

2

|

1

|

|

| 1 | Aviation | 6 | |||||

| 2 | Defence | 5 | |||||

| 3 | Interior | 1 | |||||

| 4 | Finance | 5 | |||||

| 5 | Transport | 5 | |||||

| 6 | National Plann. | 3 | |||||

| 7 | Petroleum | 5 | |||||

| 8 | Power | 4 | |||||

| 9 | Trade & Inv. | 5 | |||||

| 10 | Environment | 3 | |||||

| 11 | Culture & Tourism | 3 | |||||

| 12 | FCT | 5 | |||||

| 13 | Special Duties | Not Decided | Not Decided | Not Decided | Not Decided | Not Decided | Not Decided |

| 14 | Communications & Technology | 3 | |||||

| 15 | Education | 2 | |||||

| 16 | Justice | 5 | |||||

| 17 | Niger Delta | 2 | |||||

| 18 | Labour | 3 | |||||

| 19 | Youth Development | 2 | |||||

| 20 | Foreign Affairs | 5 | |||||

| 21 | Works | 4 | |||||

| 22 | Agriculture | 5 | |||||

| 23 | Information | 5 | |||||

| 24 | Sports | 4 | |||||

| 25 | Lands & Urban | 3 | |||||

| 26 | Police Affairs | 2 | |||||

| 27 | Water Resources | 3 | |||||

| 28 | Health | 3 | |||||

| 29 | Mines & Steel | 2 | |||||

| 30 | Science & Tech | 2 | |||||

| Total = 105 | 6 | 50 | 12 | 24 | 12 | 1 |

Total Score of 105

Maximum scores obtainable= 180

Scaled score =58.33%

The majority of

citizens eyewitness opinions (5 out of 9 commentators as at 28th

Jan 2015) as recorded by commentators on the article on This Day's site

was that the assessment was generally fair and comprehensive overall.

There were a few disagreements as follows; 2 out of 9 commentators felt

that Education deserved a higher score, 1 out of 9 commentators felt

that Mines, steel and solid minerals deserved a higher score and 1

out of 9 commentators felt that only Aviation had done well. The

general sentiment was that ministers performing below average without

substantiated reasons should be dropped from the cabinet.

My questions are

the following; if we accept that performance rating of the Jonathan

administration was 58.33% as at May 2013, what was the target and on

what basis is that measured and evaluated? Are citizens measuring

government on the basis of agreed performance contracts and targets?

Did the citizenry have some input in the choice of performance

measures? Were quality of life indices included in the key

performance measures for each ministry? What is the quality of

objective setting? Is the evaluation in line with performance indices

earlier set? More importantly what is the explanation for variances

and MOST importantly what were the identified risk factors and what

plans were put in place to manage the risk inherent in achieving our

corporate objectives? As we all know, "anything that can

prevent you from achieving your objectives is a risk that must be

managed".

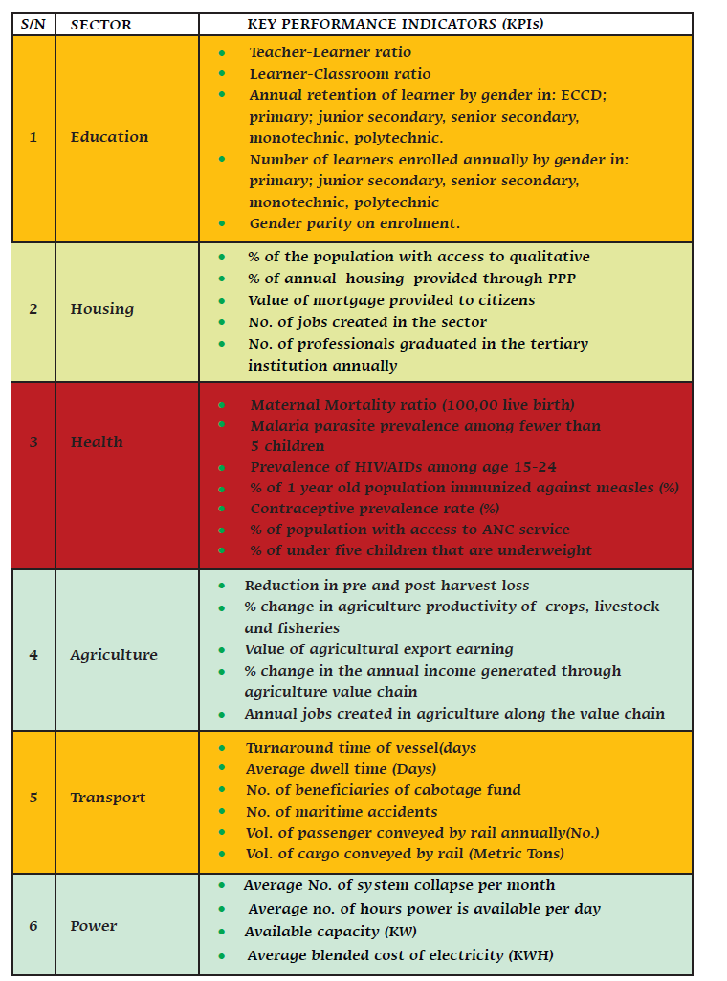

Reproduced below

are the top 15 Key performance indicators as disclosed in the 2012

National Planning Commission (NPC) performance Monitoring Report

For the reason

that anything that can prevent you from achieving your objectives is

a risk that must be managed, I visited the website of the National

Planning Commission to find out how performance and risk are measured

and managed. I was particularly interested in the department of

Monitoring and Evaluation to see what early warning signals they are

monitoring and evaluating to determine when triggers for key Risk

Indicators are being pulled.

My first discovery

is that no where in the objects clause is the measurement,

management, monitoring or evaluation of risk mentioned. I have

reproduced the objects clause below.

"Monitoring and Evaluation

The purpose of

this department is to improve the availability, quality and

dissemination of government performance information for

accountability and policy improvement purposes.

The functions

are as follows:

Develop and

maintain a framework to support the monitoring, evaluation and

reporting of government performance at the national and sub-national

levels, in line with the national development goals and objectives;

Monitor and evaluate government performance at sectoral level (to

measure performance of government policies in each sector of the

economy), institutional level (to measure performance of government

institutions) and program level (to evaluate the effectiveness and

impact of public programs); Develop and publish the Nigeria Country

Report as the primary medium for the dissemination of performance

information; Develop evaluation capacities across government at the

federal and state levels to ensure that the quality, results, and

impact of

programs and expenditure can be measured at reasonable

cost;Collaborate with MDA's to develop results-focused, key

performance indicators and clearly defined performance targets upon

which progress

will be measured; Develop the data management system for the National

M&E system, including data collection tools, identification of

data sources, frequency of data collection and data transmission

plan;"

I then reviewed the most recent National Planning Commission

Performance Monitoring Report available on the website being that for

2012 to see how risk was reported. To my surprise again, in no

section of the report was risk management addressed. To their credit,

section 4 analysed the key strategic goals and the enabling

conditions identifying KPI's but without identifying potential risk

events and developing KRI's for them.

Risk management is an essential tool in tackling the uncertainty

associated with any enterprise. Entities be they corporate

organisations or nation states have always practiced some form of

risk management, implicitly or explicitly. Enterprise Nigeria must be

practicing some form of risk management, but it is clearly

unstructured , not systematic, not holistic, not properly linked to

performance and not integrated properly across policies and across

Ministries, Departments and Agencies responsible for governance.

Nigerians are known to be very good at planning but not so good at

implementation. From my review and analysis it would appear that

Nigeria's main problem is a failure to Manage Risk Enterprise-wide

and systematically..

MY

RECOMMENDATION

Whoever wins this election should improve on the progress already

made and the good work already done to date. This improvement should

be by incorporating into NPC's object clause the enterprise-wide

management of risk for Nigeria. Nigeria should deploy an

Enterprise-wide Risk Management (ERM) framework and structure

complete with three lines of defence. Ministries and ministers should

also inherit Key Risk Indicators (KRI's) in addition to KPI's, which

their performance should be measured against. If this is done we will

have better achievement of targets and risks adequately mitigated, be

they political risks, macro-economic risks, security risks,

environmental risks, legal risks, social risks, financial risks, or

regulatory risks et cetera,will would be routinely and

properly managed preventing unwelcome surprises.

Author

Ijeoma Rita Obu, FCA, FIMC is the Managing

Partner of Ijeoma Rita Obu & Co. (Chartered Accountants) and the

CEO of Clement Ashley Consulting. For comments questions or enquiries

regarding this article please send mail to

robu@clementashleyconsulting.org

or post a comment on her blog

riskmanagementandperformance.blogspot.com